Wage and Hour Attorney

The middle class and its promise of financial security and upward mobility is increasingly out of reach for the nation’s lowest paid workers. And wage theft is just one more insult to those struggling to make ends meet. But the underpaid aren’t the only ones who suffer. Wage and hour violations collectively impact the ability of workers in affected industries to command a livable wage. As wages are driven down, low-income families increasingly turn to public assistance, straining public resources and burdening taxpayers.

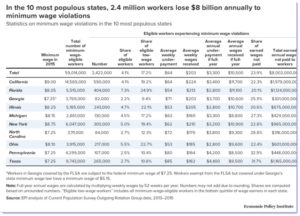

In a 2017 study conducted by the Economic Policy Institute, researchers estimate that over $15 billion in total wages are stolen each year due to minimum wage violations.

Chart courtesy of the Economic Policy Institute

Those most likely to be impacted are women, immigrants, minorities, and those with less education. Unfortunately, the large majority of wage theft victims are those least able to absorb the impact. And because many workers fear retaliation and don’t have the resources to fight for their stolen wages, many abuses go unreported.

U.S. DEPARTMENT OF LABOR INVESTIGATION RESULTS IN NEW JERSEY RESTAURANT PAYING $768,548 FOR WAGE AND VISA PROGRAM VIOLATIONS

What is wage theft?

Wage theft is the failure by an employer to pay workers the full wages to which they are entitled. It can take many forms, including:

- Federal, state, or local minimum wage violations

- Salaried workers who are not properly compensated for overtime

- Denial of meal breaks

- Improper tracking of tips or failing to pay tipped workers the difference between their tips and the legal minimum wage

- Misclassifying employees as independent contractors to pay less than minimum wage.

- Taking illegal deductions from wages

“Tipped” wage system hits food service employees the hardest

Wage and tip violations run rampant in the food service industry, with the Department of Labor reporting that almost 84 percent of full-service restaurants having violated labor standards over a two year period (2010-2012). Federal law allows for employers to pay less than minimum wage so long as earned tips make up the difference. However, tips are often miscalculated by employers, with workers often paid a reduced “tipped” wage for work that isn’t actually being tipped. This two-tiered wage system is further fraught with layers of confusing and ever-changing rules, giving an edge to business owners who have the resources and savvy to continue their infractions without their employees even knowing that they are being shorted.

Wage and hour violations under-investigated and hard to collect

The number of wage and hour violations have grown exponentially in recent years, spurred by increased globalization, more frequent outsourcing, and a decline in organized labor. Even so, the budgets for federal and state enforcement agencies has continued to decline. Businesses often take a calculated risk to violate wage and hour regulations, knowing that the likelihood of investigation is extremely low. Private lawsuits for back wages help patch part of the enforcement gap. But most lawyers steer clear from the small claims cases of low-wage workers, since they know their clients can’t afford to pay and the contingency fees will be modest.

Even if cheated employees can get someone to take their case, it is often difficult to collect on favorable settlements or judgments. A 2014 study found that over a three year period, only 17 percent of California workers with a favorable judgment were able to recover any type of payment. Employers have been known to hide assets, shut down and begin operations under a new entity, or simply disappear to avoid paying out on wage and hour claims.

What to do if you think you have been a victim of wage theft

If you are a New Jersey employee who believes your employer has violated wage and hour laws, you can file a claim with the NJ Division of Wage & Hour Compliance. All claims within the Division’s jurisdiction are investigated and decided. If you don’t get a favorable outcome, you can request a Wage Collection Proceeding where you can present evidence and testimony for your case. You may also be able to file a complaint with the U.S. Department of Labor’s Wage and Hour Division.

If you need help recovering unpaid wages or believe you are a victim of wage theft, please contact me for a free consultation.